- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Can't find your answer? Use our chat function on the bottom right and one of our team will help you out.

What information will I need to open an account?

Individual

All the requirements to open an investment account in your name.

InvestSMART will require the following details during the application process for individuals looking to open a Professionally Managed Account (PMA).

- Full Name

- Date of Birth

- Residential Address

- Phone Number (Landline/Mobile)

- Email Address

- Tax File Number (AUS) or Tax Identification Number (O/Seas)

- Australian Bank Account details

- (BSB & Account Number)

- One Additional Source of Identification

- (Australian License/Medicare/Passport)

Like all account types, you'll be asked to specify:

- an initial Investment Amount

- the Investment Model(s)

- the Investment Allocation(s)

- any Income Preference

- a Regular Contribution Plan

- a Regular Withdrawal Plan

Overseas or not an Australian Citizen?

If you're currently living abroad, paying tax abroad or simply not an Australian citizen, then please use the article below to view some additional information about your application requirements.

Do I need to be an Australian citizen or living in Australia to invest?

Joint

All the requirements to open an investment account for yourself and jointly with one other adult.

InvestSMART will require the following details for each individual looking to open a joint Professionally Managed Account (PMA).

- Full Name

- Date of Birth

- Residential Address

- Phone Number (Landline/Mobile)

- Email Address

- Tax File Number (AUS) or Tax Identification Number (O/Seas)

- Joint Australian Bank Account details

- (BSB & Account Number)

- One Additional Source of Identification

- (Australian License/Medicare/Passport)

Like all account types, you'll be asked to specify:

- an initial Investment Amount

- the Investment Model(s)

- the Investment Allocation(s)

- any Income Preference

- a Regular Contribution Plan

- a Regular Withdrawal Plan

Overseas or not an Australian Citizen?

If you're currently living abroad, paying tax abroad or simply not an Australian citizen, then please use the article below to view some additional information about your application requirements.

Do I need to be an Australian citizen or living in Australia to invest?

Self Managed Super Fund (SMSF)

If you have a Self Managed Super Fund (SMSF), you can apply for an InvestSMART PMA.

We offer two types of SMSF accounts depending on how your SMSF is structured. If you're unsure how your SMSF is structured, it's best to contact your tax or financial advisor. Alternatively, you can email a copy of the SMSF Trust Deed to invest@investsmart.com.au.

.png)

Above: Account choice shown during application

SMSF Individual

- You have two to four individuals listed as trustees of the SMSF

SMSF Corporate

- a company, such as a Pty Ltd, is listed as the trustee

- the company will have one or more directors

InvestSMART will require different details depending on the structure of your SMSF, so please see the relevant option below to see the correct requirements for you.

What do I need to apply for my SMSF (Individual Trustees)?

For each individual listed as a trustee, we'll need:

- Full Name

- Date of Birth

- Residential Address

- Phone Number (Landline/Mobile)

- Email Address

- One Additional Source of Identification (License/Medicare/Passport)

To verify the SMSF as an entity, we need:

- Superannuation Fund Name

- The SMSF's Australian Business Number (ABN)

- The Superannuation Fund's Bank Account

- BSB & Account Number

What do I need to apply for my SMSF (Corporate Trustee)?

For each individual(s) listed as director(s) of the corporate entity acting as the trustee for the SMSF, we'll need:

- Full Name

- Date of Birth

- Residential Address

- Phone Number (Landline/Mobile)

- Email Address

- One Additional Source of Identification (License/Medicare/Passport)

To verify the SMSF as an entity, we need:

- Superannuation Fund Name

- The SMSF's Australian Business Number (ABN)

- The Superannuation Fund's Bank Account

- BSB & Account Number

We will also require the following details to verify the corporate trustee as an entity.

- The name of the company that is the trustee of the SMSF

- Australian Company Number (ACN)

- Principal Place of Business Address

- Registered Office Address

Like all account types, you'll be asked to specify:

- an initial Investment Amount

- the Investment Model(s)

- the Investment Allocation(s)

- any Income Preference

- a Regular Contribution Plan

- a Regular Withdrawal Plan

Trusts (Family, discretionary etc.)

All the requirements to open an account for your Trust.

In Australia, you have a choice between two structures for your Trust where:

- individuals are listed as trustee (Individual Trustee)

- a company is listed as trustee (Corporate Trustee)

InvestSMART will require different details depending on the structure of your Trust, so please see the relevant option below to see the correct requirements for you.

How can I apply for my Trust (Individual Trustees)?

InvestSMART will require the following details from those individuals listed as trustees for the Trust looking to submit an application to open a Professionally Managed Account (PMA).

- Full Name(s)

- Date of Birth(s)

- Residential Address

- Phone Number (Landline/Mobile)

- Email Address

- One Additional Source of Identification (License/Medicare/Passport)

We will also require the following details relating to the Trust itself.

- Trust Name Australian Business Number (ABN)

- Tax File Number (TFN)

- Trust Bank Account (BSB & Account Number)

If your Trust doesn't have an Australian Business Number (ABN) then we will require you to arrange for three pages of the Trust deed to be certified, within the last three months, and emailed to us at invest@investsmart.com.au and they are:

- Cover Page

- Schedule Page

- Signature Page

All other requirements will be personal preferences for initial life of your account.

- Investment Amount

- Investment Model(s)

- Investment Allocation(s)

- Income Preference

- Regular Contribution Plan

- Regular Withdrawal Plan

How can I apply for my Trust (Corporate Trustee)?

InvestSMART will require the following details from those individuals listed as directors of the corporate entity acting as trustee for the Trust looking to submit an application to open a Professionally Managed Account (PMA).

- Full Name(s)

- Date of Birth(s)

- Residential Address

- Phone Number (Landline/Mobile)

- Email Address

- One Additional Source of Identification (License/Medicare/Passport)

We will also require the following details in order to verify the corporate trustee entity.

- Company Name

- Australian Company Number (ACN)

- Principal Place of Business Address

- Registered Office Address

We will also require the above mentioned details relating to the Trust itself.

For children

How can I apply to invest on behalf of my children, grandchildren or others under 18? InvestSMART caters for those who wish to create an investment portfolio for those who are yet to turn 18 and be legally allowed to invest in their own name.

We have an online application for this type of investment. It will require an adult/s to "act as trustee" for the minor, but please keep in mind that this doesn't create a legal trust in the manner that of a family or discretionary trust. It will also require either the adult/s or the minor to provide their Tax File Number (TFN) and accept tax liability for the investments held.

Please consult your tax professional if you have any doubts over which option will be best for your circumstances.

We will require the adult/s to provide the following details to act as trustee.

- Full Name

- Date of Birth

- Residential Address

- Tax File Number - if accepting tax liability

- One Additional Source of Identification (License/Medicare/Passport)

We will require the following details for the minor:

- Full Name

- Date of Birth

- Residential Address

- Tax File Number - if accepting tax liability

In addition there would need to be an Australian bank account provided that is either in the name of the adult, the child or the adult as trustee for the child.

Do I need to be an Australian citizen or live in Australia to invest?

Here's everything you need to know about investing with us if you currently live or are based overseas or an overseas citizen.

You are not required to be an Australian citizen or currently residing or living in Australia to open a Professionally Managed Account (PMA). Still, you and/or your entity will be subject to the same verification requirements.

Required details:

You must be able to provide the following details to invest with us:

- an Australian Bank Account

- a Tax Identification Number (TIN) and Country of Tax Residence

- a Certified Passport - Valid within three months

- Proof of Residency -

- Australia within three months

- Overseas within six months

Below is the list of people who can certify documents overseas.

Overseas Approved ID Certifiers

- Police officer

- Judge, Magistrate, Registrar or Deputy Registrar of a court

- Lawyers

- Notary Public

- Consular Official

- Australian consular officer or an Australian diplomatic officer (within the meaning of the Consular Fees Act 1955)

- An employee of the Australian Trade Commission who is:

- a) in a country or place outside Australia; and

- b) authorised under paragraph 3(d) of the Consular Fees Act 1955; and exercising their functions in that place;

- An employee of the Commonwealth who is:

- a) in a country or place outside Australia; and

- b) authorised under paragraph 3 (c) of the Consular Fees Act 1955; and exercising their function in that place.

How to apply

You will still be required to apply through our website.

When asked for an address, please enter:

Level 2, 66 Clarence Street Sydney, NSW 2000 Australia(This is InvestSMARTs address)

Online ID Verification

You can skip this step when asked to complete the online ID verification.

Next Steps

Once you submit your application, we will email you requesting:

- Certified ID

- Proof of your residential address (not certified)

Please feel free to contact our friendly team if you have further questions via online chat or email at invest@investsmart.com.au.

How do I complete the initial funding?

When you submit your investment application online our Operations Team will receive a digital copy of the application for review and approval.

After approval you will be sent a confirmation email and the funding details.

InvestSMART uses the BPAY system as it allows for efficient and accurate tracking of numerous payments received on a daily basis. Please keep your BPAY details on file as you can continue to use them for contributions in the future.

We do not issue details for Electronic Funds Transfer (EFT).

We are aware that you may have daily limits for transfers using BPAY but you may not know it is possible to temporarily or permanently change these limits by speaking to your financial institution.

Alternatively, if you would prefer we are more than happy to receive your initial funding across multiple payments and we will await the full amount before commencing the investment process.

Related topics

Do I receive franking credits and do I get a tax statement?

Yes. You will receive a comprehensive tax statement at the end of financial year and you will receive the franking you're entitled to once you submit your tax return.

What portfolio should I invest in?

Choosing the right portfolio depends on your investment goals, time frame, and risk tolerance. To help you decide, consider the following:

1. Investment Time Frame: Each portfolio has a suggested time frame. Ensure it aligns with your financial goals:

2. Target Market Determination (TMD): Review the PMA Target Market Determination to understand the intended investor profile for each portfolio.

3. Tools & eBook Guides: InvestSMART provides several resources to help you choose the right portfolio.

Here is a list of tools and guides to help select the right portfolio:

- InvestSMART's Statement of Advice – A tailored Investment Plan with step-by-step guidance.

- Guide to Growing Wealth – Strategies to build your portfolio.

- Guide to Investing in Retirement – Insights for managing your investments during retirement.

- Investor Pack – A comprehensive overview of InvestSMART’s offerings.

Calculators:

- Wealth Savings Calculator

- Property Savings Calculator

- Education Savings Calculator

- Retirement Savings Calculator

For a deeper dive into investing, explore InvestSMART Bootcamp, a complete investment course designed to help you get started.

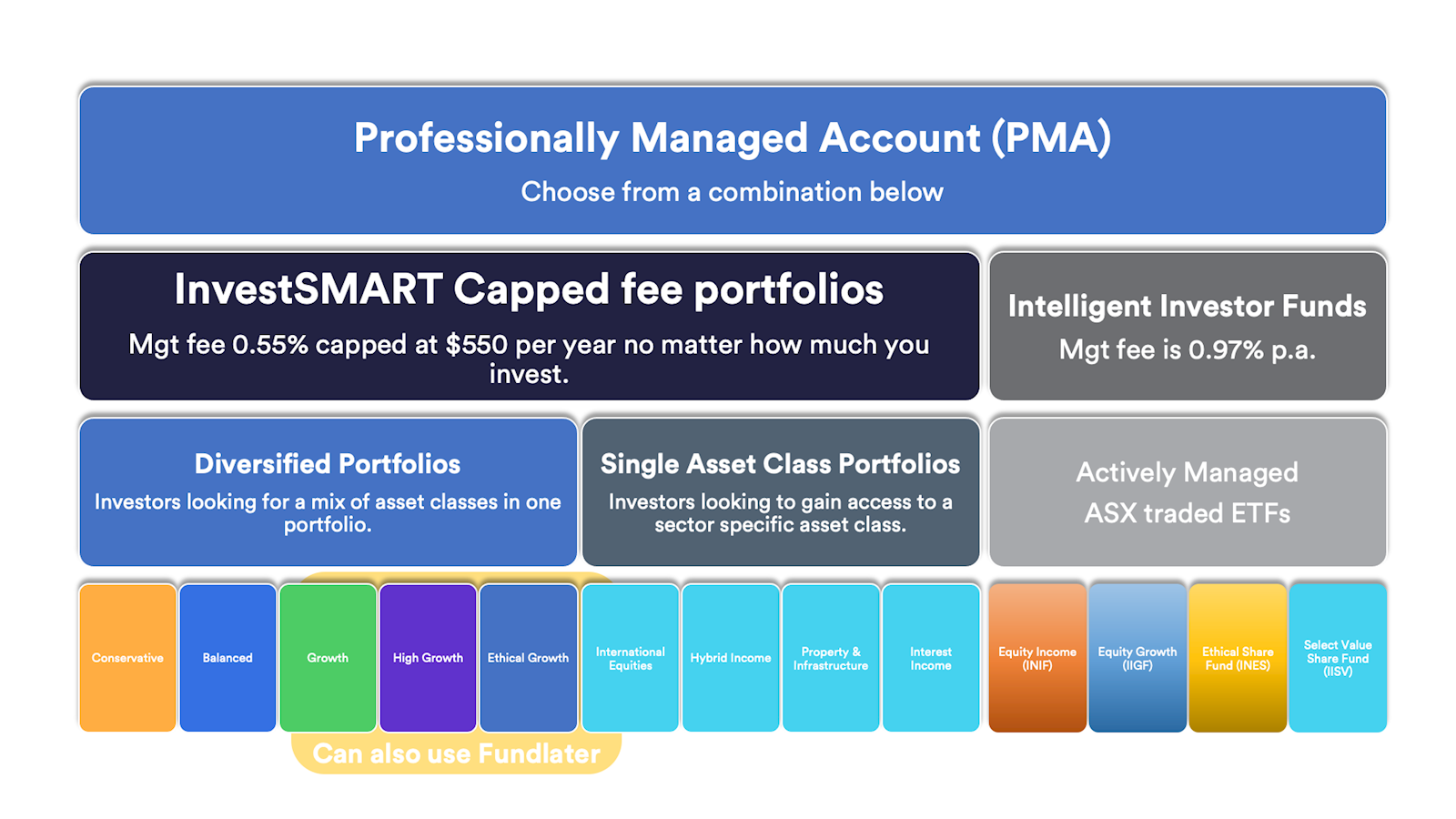

What is a Professionally Managed Account?

The InvestSMART Professionally Managed Account (PMA) is established and offered within the registered managed investment scheme known as the Professionally Managed Accounts.

Each investor has a separate account to which their investments are allocated. You will require a different PMA for each investment entity you have e.g. individual, joint, SMSF etc.

A client will open an InvestSMART PMA and can then choose between the various InvestSMART Diversified Portfolios. An account can hold one or more models but can only hold one diversified portfolio. The management fee is charged at the account level, not per portfolio.

Once you decide which model portfolio(s) are best suited to your investment needs and objectives, we will purchase the investment to be included in your account to reflect the model portfolio or combination of model portfolios that you have selected.

What does InvestSMART invest in?

When you open an InvestSMART Professionally Managed Account (PMA), you choose from InvestSMART's range of Diversified Portfolios to invest in.

A list of the portfolios can be found here.

These managed portfolios comprise of Exchange Traded Funds (ETFs) or, in some cases direct shares. In particular, the InvestSMART Hybrid Income Portfolio invests in Australian listed hybrids and listed debt securities.

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a managed fund that trades on the stock market.

There are different types of ETFs, each with its own purpose, but most commonly, they will track or follow a particular index.

For example, if you want to follow or track the S&P ASX 200 (the top 200 Australian shares by market capitalisation), you could either buy each individual share (200 shares) or one ETF. The one ETF wraps up the 200 shares into one holding. By holding this one ETF, you get exposure to the movements of the ASX 200, less any fees.

Investing in ETFs is a form of passive investing, and they generally incur cheaper management fees, as fewer investment decisions are required to manage an ETF. They are also quite liquid and traded easily on an exchange.

You can see the holdings of each InvestSMART managed portfolio by navigating to its product page and scrolling to Key Facts > Holdings.

Do I own the shares/ETFs?

Yes, all investments held within your InvestSMART PMA are held in your name (or chosen entity e.g. SMSF) in a CHESS sponsored broking account.

You are the registered legal and beneficial owner of a portfolio of securities. You can log into the investor website at any time to view the individual securities that make up your Account.

.png)