- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Closing an account

Each portfolio has a minimum investment amount of $10,000 (the exception is the Investsmart Interest Income Portfolio).

If you have multiple portfolios, you'll need the minimum of $10,000 to keep each open.

Example:

You have one portfolio the InvestSMART Property and Infrastructure so your minimum is $10,000.

You have two portfolios, InvestSMART Property and Infrastructure and the Investsmart Interest Income Portfolio so your minimum is $10,000 in each, so the total miminum is $20,000.

To withdraw funds from the dashboard, click on More > Withdrawal.

Yes, you can complete a broker to broker transfer or an Off Market Transfer. Please contact us to obtain the correct form at invest@investsmart.com.au. Transferring one holding out will void the portfolio. This means the existing holdings in that portfolio will be liquidated and the cash reserve returned to you. This will close the account.

Note: A fee of $27.50 per line of stock may apply for transfers out. Refer to the PDS for more information.

To close an account, click on:

-

On the Dashboard, select More on the left sidebar, then Withdrawal

-

Select Withdrawal Request

-

Tick the Close Account box (see 4 below)

-

Submit and Verify Request (Email or SMS)

.png)

The holdings will be sold down and when the transactions settle the funds will be transferred to the bank account we have on file. It's a good idea to first check your bank account on file here.

Please allow up to five business days to receive the funds.

Please note that account closures are final however you can reapply if you wish to open a PMA account in the future.

No, you will need to open a new account.

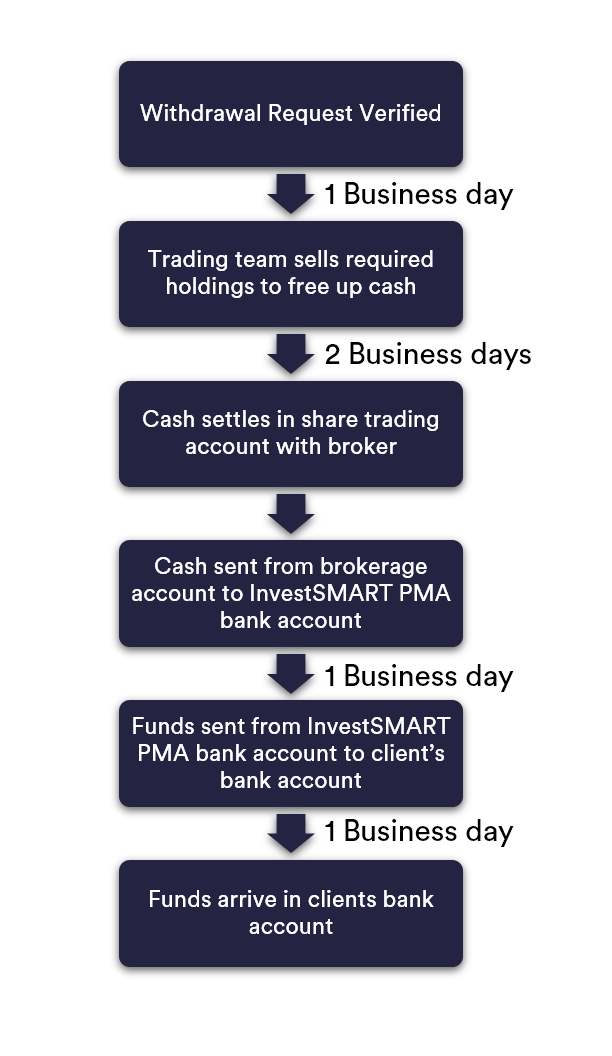

Withdrawals typically take 4-5 business days from the day you verified the withdrawal request.

Because of the delay with data reflected in the My Account section, you may see your cash component in your PMA larger than usual.

This increased cash holding is temporary and shows that the cash has been 'freed up' and will shortly be sent to your nominated bank account.

Why does it take 4-5 business days and not immediately?

We're proud to offer low and capped management fees for our InvestSMART investment products. At the heart of everything we do, our purpose is to make investing rewarding, accessible and affordable.

To keep fees low and capped, we take a process-driven approach. For instance, our trading team can keep costs down by trading once a day during a specific period. This means that withdrawal requests that are verified and submitted are actioned the following business day.

Settlement periods

As with any ASX listed share or ETF, there is a two business days settlement period. The ASX explains this here. This settlement period means your funds won't be available until two days after the transaction takes place.

Your investments are held in a CHESS sponsored brokerage account. This adds an extra layer of protection and can offer more tax advantages as you can transfer holdings to your share trading account and not be forced to sell them. However, this means that getting funds from your brokerage bank account to the InvestSMART bank account adds an extra step. We are in the process of investigating CMA accounts to improve this.

What can I do to help?

Please be aware of the four to five day withdrawal period and factor in potential public holidays that may extend the process.

You can view and manage your InvestSMART PMA online.

If you are already invested, visit the Dashboard section of the website to view:

- Investment Summary

- Current Holdings

- Goal tracker

- Transactions

- Dividends & Interest

- Deposits & Withdrawals

- InvestSMART Fees

- Allocation Preferences

- Investment Preferences

Your portfolio data is updated daily. Please note, you will always see the previous days closing values.

You can switch between Model Portfolios or alter the combination of Model Portfolios on which your portfolio is constructed at any time. Your instruction will generally be acted upon during the next rebalancing date after receiving your request online.

You can submit this request by taking the following steps from the Investment Dashboard:

- Select More on the left sidebar

- Click Modify Allocation

- Provide New Allocation Breakdown by Percentage (%) or Dollar value($) and then select Next

- Select Verification and use preferred option - Email or SMS

- Complete Verification

If your request requires additional funds to be transferred then the details will be shown in accordance with what you need to contribute along with the BPAY details unique to your investment account.

If you require assistance, please contact our friendly team via the chat function in the bottom right corner.

We are commonly asked by new clients browsing their holdings in the Portfolio Manager why they have physical cash sitting in their investment portfolio. Surely it should be invested in more shares?

There are four reasons why this may be occurring:

Cash Component

As referenced in our Product Disclosure Statement, every Professionally Managed Account (PMA) will hold, at the very least, 1% of the total account value in a cash component at all times.

InvestSMART draws upon this cash component to cover management fees and brokerage costs (if required), removing the need to unnecessarily sell down investments to cover the aforementioned expenses, which would be counterproductive to the progress of your investment.

Portfolio Manager Discretion

At any point in time, the Portfolio Manager of any Model Portfolio has the discretion to adjust the holdings and weightings held, including physical cash. While this is more likely to impact active stock-picking portfolios rather than our capped-fee investment portfolios, it's not unusual to see 5% physical cash held by some models.

Contributions or Income

Over time your investments will pay dividends or distributions with the proceeds deposited into your cash component, and dependent on your income setting, it will either be accumulated and paid to your nominated bank account or held for reinvestment at the next rebalance.

Contributions are also held similarly. They will be initially deposited into the cash component until there are enough available funds to trigger a rebalance of your holdings.

The myth of "Full Investment"

Lastly, there is a common-sense reason why there might be a little more physical cash in your account. We aren't able to necessarily deploy every cent we'd like to due to the fluctuations in the price of underlying holdings on any one day, i.e. if we want to purchase $500 of ABC to rebalance your portfolio but only have $100 available, then we will have to hold fast for the time being.

Remember:

This is a Professionally Managed Account (PMA), meaning that we manage this for you. Any trading, readjusting, rebalancing is done automatically by InvestSMART.

If you have any further questions or want clarification on the above topics, then please feel free to email us at invest@investsmart.com.au

We sometimes get asked, "Why does portfolio performance differ from the model performance?"

Your account is designed to track the InvestSMART model portfolios you have chosen to invest in. We operate model portfolios with specific percentages assigned to the holdings and invest in the same holdings for your account to mirror the model. When the model holdings change so to will your account holdings.

Here are some common reasons why your investment return may differ from the model portfolio you are tracking:

Income sweep: If you have the Income Sweep turned on you are having the dividends paid out to you, therefore removing that cash from your portfolio. This may make it seem like your returns are lower than they are.

Your inception date: Our published model performance figures are based on month end values. For example, model performance may be +5% from 30 November to 31 December. If you established your portfolio on the 5th November and attempted to compare performance, your return may look quite different.

Adjusting/changing investment models: If you adjust your model weights during the performance reporting period, your returns may differ to our published performance. By adjusting models during the period, it becomes more difficult to obtain a like for like comparison against model performance returns.

Adding or withdrawing funds: Adding or withdrawing funds will see InvestSMART needing to buy or sell securities/shares in your account during the month. This will see you purchase or sell securities/shares at a price that may differ from the end of month price.

Size of portfolio balance: Our models operate off percentages. The larger the size of the portfolio the easier it is to match those percentages. Some accounts holdings may vary to model security weights as the high dollar value of a security (E.g., $100-600 depending on the ETF) means we can’t buy as many as is required to get close to the model weight. These residual amounts are therefore held as cash which has the effect of dampening returns when securities are going up. Of course, where securities fall, this has the effect of improving returns relative to model.

|

Actual Weight |

|||||||

|---|---|---|---|---|---|---|---|

|

|

Price per unit |

Model Weight |

$1m Portfolio |

$100K Portfolio |

$10K Portfolio |

||

|

|

|||||||

|

AAA |

$50.07 |

14.00% |

14.00% |

13.97% |

13.52% |

||

|

IAF |

$109.35 |

22.50% |

22.49% |

22.42% |

21.87% |

||

|

IFRA |

$21.77 |

2.75% |

2.75% |

2.74% |

2.61% |

||

|

IOZ |

$30.32 |

21.00% |

21.00% |

20.98% |

20.92% |

||

|

VAP |

$93.00 |

2.75% |

2.74% |

2.70% |

1.86% |

||

|

VBND |

$47.43 |

12.00% |

12.00% |

12.00% |

11.86% |

||

|

VGS |

$105.04 |

24.00% |

23.99% |

23.95% |

23.11% |

||

|

CASH |

$1.00 |

1.00% |

1.02% |

1.24% |

4.25% |

||

|

100.00% |

100.00% |

100.00% |

100.00% |

||||

Brokerage: The investment models do not factor in brokerage. If you add funds, withdraw funds, or change investment model’s transactions occur and so do brokerage costs.