- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

- Cashback FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Please explain the fees further

Our capped management fees are tiered depending on your investment amount.

Fees matter and have a significant impact on your net investment returns. We have a fee structure of 0.44% p.a. capped at $880 per year no matter how much you invest*.

|

Account balance tiers |

Investment management fees p.a. |

|---|---|

|

$0 to $200,000 |

0.44% |

|

More than $200,000 |

$880 |

See the interactive slider here: https://www.investsmart.com.au/capped-fees

* InvestSMART's capped Management Fee (capped at $880 p.a.) does not include fees charged within any ETF held in this portfolio, estimated to be approximately 0.18% (indirect cost ratio), and our flat 0.11% admin fee – this covers buy-side brokerage costs. Sell side brokerage costs are not included in this calculation. For more information about fees and costs, please see the Product Disclosure Statement and Investment Menu.

Our investors are the legal owners of the holdings in their accounts. As we open a brokerage account on your behalf, your investments are registered in your name with CHESS. Because of this, there are brokerage charges.

Buy-Side Brokerage

InvestSMART applies a flat 0.11% administration fee, which covers all buy-side brokerage costs. This fee also supports ongoing enhancements to our platform and investment tools, ensuring a seamless and high-quality investing experience.

This means you will not incur additional brokerage charges when:

- Creating your portfolio and buying holdings

- Adding funds to your account and buying holdings

- Rebalancing your portfolio (buying holdings to maintain portfolio objectives)

Sell-Side Brokerage

You will still incur brokerage fees when we sell holdings, which happens in the following scenarios:

- Withdrawing funds from your account and selling holdings to free up cash for the withdrawal

- Closing your portfolio and selling all holdings

- Rebalancing your portfolio (selling holdings as part of the process)

InvestSMART has negotiated wholesale brokerage rates for sell-side trades: the greater of $4.40 per trade or 0.044% of the trade's value. Each portfolio contains up to seven holdings, and you can view them by navigating to Key Facts > Allocations > Current Holdings on each portfolio’s product page.

For example:

- A $1,000 sale of share ABC incurs a brokerage fee of $4.40

- A $20,000 sale of share ABC incurs a brokerage fee of $8.80

It is important to note that our investments are not actively traded, and we do not receive any portion of the costs associated with trading.

You will incur brokerage when we have to trade (buy or sell) holdings. We make trades for these reasons:

- Creating your portfolio and buying holdings

- Adding funds to your account and buying holdings

- When rebalancing your portfolio, so it stays in line with the portfolio objectives.

- Rebalancing may involve the buying of some holdings and the selling of others.

- You are withdrawing funds from your account and selling holdings to free up cash for the withdrawal.

- Closing your portfolio and selling all holdings

No, you're charged the one management fee.

-

You can hold more than one investment model in the same account.

-

You can hold one diversified portfolio and/or multiple single asset class portfolios.

If the portfolio model is part of our capped fee range, the one management fee will apply to your account as a whole.

Fees matter and have a significant impact on your net investment returns. We have a fee structure of 0.44% p.a. capped at $880 per year no matter how much you invest.*

For example, if you hold the InvestSMART Balanced Portfolio and the InvestSMART International Portfolio, you will only pay a maximum of $880 p.a. on your portfolio and not $880 p.a. per model.

| Account balance tiers | Investment management fees p.a. | Administration fees |

| $0 to $200,000 | 0.44% | 0.11% |

| More than $200,000 | $880 | 0.11% |

* InvestSMART's capped Management Fee (capped at $880 p.a.) does not include fees charged within any ETF held in this portfolio, estimated to be approximately 0.18% (indirect cost ratio), and our flat 0.11% admin fee – this covers buy-side brokerage costs. Sell side brokerage costs are not included in this calculation. For more information about fees and costs, please see the Product Disclosure Statement and Investment Menu.

The admin fee is 0.11% per annum. The fee will apply to all assets, including Intelligent Investor Active ETFs held in your PMA.

This fee will cover all brokerage on purchases and help us continue to build the best platform experience and investment tools for our customers whilst maintaining low fees.

The table below display an estimate of fees per annum depending on account balance:

| $10,000 | $50,000 | $100,000 | $500,000 | |

| Estimated brokerage | $23 | $60 | $73 | $234 |

| Management Fee | $44 | $220 | $440 | $880 |

| Administration Fee | $11 | $55 | $110 | $550 |

| Total Fees | $78 | $335 | $623 | $1,664 |

The examples above only include the estimated brokerage costs, averaged across each model portfolio, for rebalancing, top ups and withdrawals based on an average investor, and do not include brokerage costs for initiating or switching an investment.

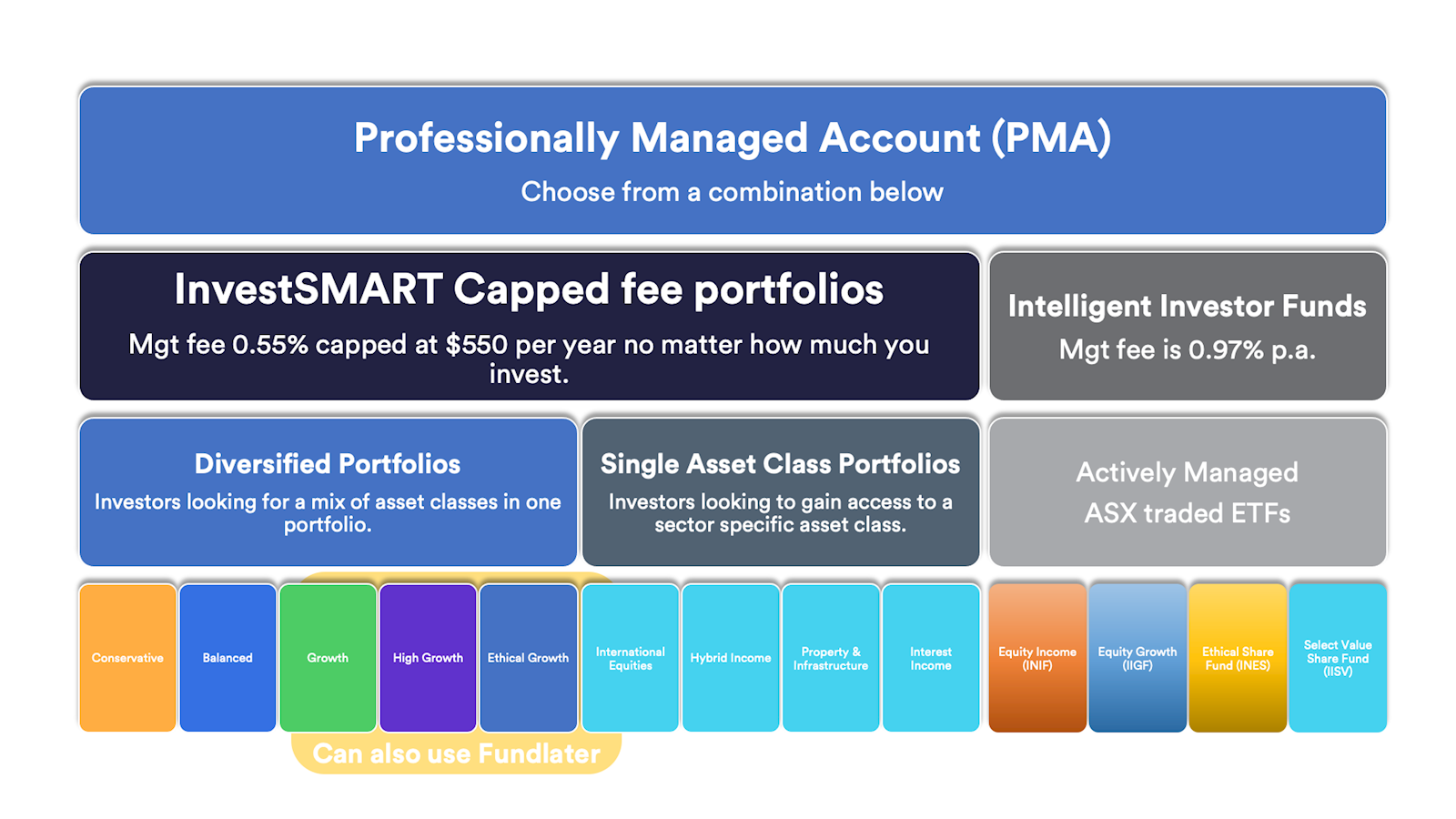

You can choose to hold both InvestSMART portfolios and Intelligent Investor funds within your portfolio, side by side.

The InvestSMART portfolios are part of the capped fee range.

The Intelligent Investor funds are not part of the capped fee range, and management fees apply at 0.97% p.a. All holdings in a PMA are charged 0.11% admin fee - this applies to the InvestSMART portfolios and Intelligent Investor funds.

Example:

You have $100,000 in your InvestSMART PMA.

-

InvestSMART Balanced Portfolio – $85,000

-

Intelligent Investor Equity Growth Fund (Managed Fund) (ASX:IIGF) – $15,000

Fees:

InvestSMART Balanced Portfolio

-

Capped management fee: 0.44% = $374

-

Admin fee: 0.11% = $93.50 ($85,000 × 0.11%).

Intelligent Investor Equity Growth Fund

-

Management fee: 0.97% = $145.50 ($15,000 × 0.97%).

-

Admin fee: 0.11% = $16.50 ($15,000 × 0.11%).

Total Fees: $1,135 per annum.

Our investments utilise Exchange Traded Funds (ETFs) as we believe they offer our clients diversified, liquid and low-cost exposure to a number of asset classes in Australia and overseas.

Exchange Traded Funds as the name would suggest are listed on an exchange, in this instance the Australian Stock Exchange (ASX), by Fund Managers who in turn charge a modest management fee on a percentage basis.

We are conscious that this fee will impact your overall returns and it is closely monitored for each portfolio; at time of print it varies from 0.09% p.a. to 0.30% p.a.

Your Account will also incur indirect costs incurred due to the fees and costs associated with the underlying investments in the selected Model Portfolio/s. The current indirect costs information for each Model Portfolio is set out in the Investment Menu.

Indirect costs are deducted by the underlying managed fund/ETF and are included in the ETF price.

They are not separately deducted from your Account. The fund manager charges these management fees regardless of whether you held them through InvestSMART or your own brokerage account.

For example:

You hold the InvestSMART Conservative Portfolio. One of the holdings is an ETF called the iShares MSCI Australia 200 ETF (IOZ). It has a 0.09% p.a. management fee charged by Blackrock within the fund. If it is currently trading at a Sell/Buy price of 28.68/28.70, then 0.09% would be taken from the Sell price (as this values your holding of IOZ). This would then be calculated on a monthly basis.

Yes. You will receive a comprehensive tax statement at the end of financial year and you will receive the franking you're entitled to once you submit your tax return.

Choosing the right portfolio depends on your investment goals, time frame, and risk tolerance. To help you decide, consider the following:

1. Investment Time Frame: Each portfolio has a suggested time frame. Ensure it aligns with your financial goals:

2. Target Market Determination (TMD): Review the PMA Target Market Determination to understand the intended investor profile for each portfolio.

3. Tools & eBook Guides: InvestSMART provides several resources to help you choose the right portfolio.

Here is a list of tools and guides to help select the right portfolio:

- InvestSMART's Statement of Advice – A tailored Investment Plan with step-by-step guidance.

- Guide to Growing Wealth – Strategies to build your portfolio.

- Guide to Investing in Retirement – Insights for managing your investments during retirement.

- Investor Pack – A comprehensive overview of InvestSMART’s offerings.

Calculators:

- Wealth Savings Calculator

- Property Savings Calculator

- Education Savings Calculator

- Retirement Savings Calculator

For a deeper dive into investing, explore InvestSMART Bootcamp, a complete investment course designed to help you get started.

The InvestSMART Professionally Managed Account (PMA) is established and offered within the registered managed investment scheme known as the Professionally Managed Accounts.

Each investor has a separate account to which their investments are allocated. You will require a different PMA for each investment entity you have e.g. individual, joint, SMSF etc.

A client will open an InvestSMART PMA and can then choose between the various InvestSMART Diversified Portfolios. An account can hold one or more models but can only hold one diversified portfolio. The management fee is charged at the account level, not per portfolio.

Once you decide which model portfolio(s) are best suited to your investment needs and objectives, we will purchase the investment to be included in your account to reflect the model portfolio or combination of model portfolios that you have selected.

When you open an InvestSMART Professionally Managed Account (PMA), you choose from InvestSMART's range of Diversified Portfolios to invest in.

A list of the portfolios can be found here.

These managed portfolios comprise of Exchange Traded Funds (ETFs) or, in some cases direct shares. In particular, the InvestSMART Hybrid Income Portfolio invests in Australian listed hybrids and listed debt securities.

What is an Exchange Traded Fund?

An Exchange Traded Fund, or ETF, is a managed fund that trades on the stock market.

There are different types of ETFs, each with its own purpose, but most commonly, they will track or follow a particular index.

For example, if you want to follow or track the S&P ASX 200 (the top 200 Australian shares by market capitalisation), you could either buy each individual share (200 shares) or one ETF. The one ETF wraps up the 200 shares into one holding. By holding this one ETF, you get exposure to the movements of the ASX 200, less any fees.

Investing in ETFs is a form of passive investing, and they generally incur cheaper management fees, as fewer investment decisions are required to manage an ETF. They are also quite liquid and traded easily on an exchange.

You can see the holdings of each InvestSMART managed portfolio by navigating to its product page and scrolling to Key Facts > Holdings.

Yes, all investments held within your InvestSMART PMA are held in your name (or chosen entity e.g. SMSF) in a CHESS sponsored broking account.

You are the registered legal and beneficial owner of a portfolio of securities. You can log into the investor website at any time to view the individual securities that make up your Account.

.png)