How procrastinating can cost you money

It was Benjamin Franklin who said, "Don't put off until tomorrow what you can do today." These are wise words, but it's estimated that 95% of us procrastinate to some degree, with around 20% of us chronic procrastinators.

Procrastination is the act of delaying an important task, often until the last minute. It involves avoiding boring or difficult tasks, in favour of tasks that are more enjoyable.

We can also procrastinate when it comes to investing. Leaving this task until sometime down the track, can greatly reduce our future wealth (more on this later) and prevent us from achieving our financial goals.

Reasons you may be procrastinating with investing

There are many reasons why you may procrastinate with starting your investment journey. Here are a few of those reasons.

- You're unsure of what to do to get started.

- You're scared that you may lose money.

- You're feeling overwhelmed by the research required to invest.

- You think you don't have enough money to invest.

- You're waiting for the right time to invest.

When starting out on your investment journey, it's important to identify any issues that concern you with investing, and then find the answers you need. After all, the long-term benefits of investing in a diversified portfolio are considerable, so you want to make sure you start off on the right foot.

How procrastination can cost you money

What you may not realise, is that over the long-term, procrastination could end up costing you thousands of dollars. That's largely down to compounding.

The late Charlie Munger once said, "Getting wealthy is like rolling a snowball. It helps to start on top of a long hill. Start early and try to roll that snowball for a very long time." Doing this allows compounding to occur.

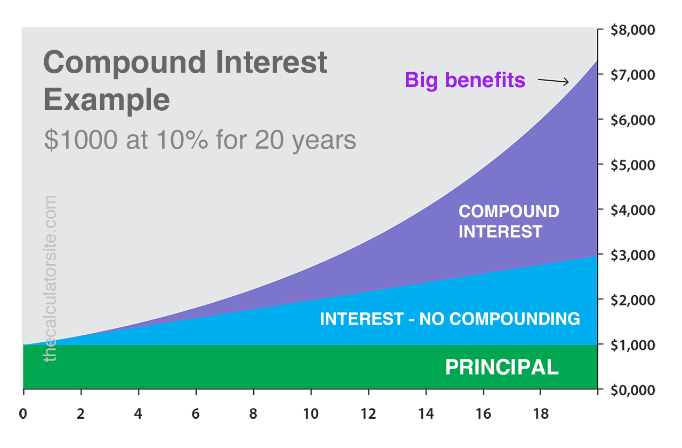

The compounding effect is when we earn returns on a principal sum, and then earn further returns in future periods, on the combined amount (i.e. principal and returns).

The graph below shows what happens when interest is compounded. Notice that the big benefits occur near the end of the time period. This is why Munger said, "The first rule of compounding is to never interrupt it unnecessarily."

Now, let's look at what delaying investing could potentially cost you.

To get an idea of the returns possible with investing, we can look at the Vanguard 2023 Index Chart, which shows the investment returns of various asset classes over 30 years to 30 June 2023. The returns assume that all dividends are reinvested.

The best-performing asset class was US Shares, which rose on average 10.0% a year over the 30-year period, followed by Australian shares which averaged 9.2% a year over the same period. In our example, for simplicity's sake, we've assumed that the share market returns 10% a year (with dividends reinvested), and the investor invests for 30 years.

The table below shows the impact delaying your initial investment by one year, five years and 10 years could have on your future wealth. It also highlights why Einstein described compound interest as the "Eighth Wonder of the World".

The cost of procrastinating

|

Year |

Smart Investor |

Late Investor - 1 Year |

Late Investor - 5 Years |

Late Investor - 10 Years |

|

0 |

$10,000 |

|

|

|

|

1 |

$11,000 |

$10,000 |

|

|

|

2 |

$12,100 |

$11,000 |

|

|

|

3 |

$13,310 |

$12,100 |

|

|

|

4 |

$14,641 |

$13,310 |

|

|

|

5 |

$16,105 |

$14,641 |

$10,000 |

|

|

6 |

$17,715 |

$16,105 |

$11,000 |

|

|

7 |

$19,487 |

$17,715 |

$12,100 |

|

|

8 |

$21,435 |

$19,487 |

$13,310 |

|

|

9 |

$23,579 |

$21,435 |

$14,641 |

|

|

10 |

$25,937 |

$23,579 |

$16,105 |

$10,000 |

|

15 |

$41,772 |

$37,974 |

$25,937 |

$16,105 |

|

20 |

$67,274 |

$61,159 |

$41,772 |

$25,937 |

|

25 |

$108,347 |

$98,497 |

$67,274 |

$41,772 |

|

30 |

$174,494 |

$158,630 |

$108,347 |

$67,274 |

As you can see, compounding works for all investors but the investor who was in the market the longest clearly did the best.

Having just a one-year delay in making the initial $10,000 investment, resulted in wealth being reduced by $15,864.

A delay of five years resulted in wealth being reduced by $66,147 and a delay of 10 years resulted in a drop of $107,220.

5 tips to help you overcome investment procrastination

Here are five strategies you can put in place to help you beat investment procrastination:

1. Work out what is causing you to procrastinate with investing. Once you identify this, then you can start to address it. For example, if you feel you don't know enough about investing, then begin by reading investment articles or books. If you are concerned about losing money, then you can invest just a small amount to begin with. If you want to minimise risk, then you could opt for a diversified portfolio of ETFs.

2. Make a plan. Plan out how you are going to invest, and break it down into smaller steps. See 'Six steps to help you get started' below for ideas.

3. Set aside time. Book a time into your calendar where you focus exclusively on the tasks associated with getting started with investing.

4. Set SMART investment goals. These are goals that are Specific, Measurable, Achievable, Relevant, and Time Bound. Know exactly what you want to achieve, rather than being vague. If your goal is to "be wealthy", then you may never get started. So, it's best to have a more specific goal, such as "I plan to invest $20,000 into a diversified portfolio by June 2024."

5. Get started. Every great journey begins with a single step. It sounds simple, but just starting goes a long way towards getting the task done.

Six steps to help you get started

The first thing to consider with investing, is whether it is right for you. You need to be aware that there is risk with investing, and at times the road will be bumpy.

However, it should also be remembered that with diversification and investing for the long-term, these risks can be minimised.

Here are six steps to help you get started on your investment journey:

1. Set clear investment goals.

2. Work out how much you want to invest.

3. Work out your time horizon and when you might need access to your money.

4. Measure your risk tolerance levels.

5. Understand your investment options.

6. Open a brokerage account and begin investing.

Investing in the share market may seem daunting at first, but if you break it down into smaller steps (such as the above), then the overall task becomes much easier.

Want to compare ETFs? Check out our handy online ETF filter tool. It can help you narrow down your options based on filters such as investment category or InvestSMART's star rating.